It is impossible to gain financial stability without knowing how to effectively budget your finances. With inflation consistently rising and economic fluctuation, it is more important than ever to stay on top of your finances through budgeting. With effective budgeting, you can weather the economic storm and finally save for that dream vacation, pay off your debts, build an emergency fund, or achieve any other financial goal that you may have. To help you manage your finances this year, we have curated a list of the best budgeting techniques.

1. The 50/30/20 Rule

The 50/30/20 rule remains one of the most effective strategies for budgeting your finances. This technique involves dividing your income into three categories after tax is deducted. These three categories are as follows:

50% for Needs: All the essential expenses you need to cover, such as rent, utilities, groceries, and insurance.

30% for Wants: All the nonessential purchases you want to make, such as entertainment, dining out, and vacations.

20% for Savings and Debt Repayment: All the goals you aim to achieve through saving, such as paying off debt, building an emergency fund, and investing.

2. Set Clear Financial Goals

You are more likely to preserve your motivation to budget when you have a clear goal. Therefore you can identify your financial goals for both the long term and the short term. For instance, you may be saving to pay off a credit card, which would be a short-term goal, and you may be saving to purchase a home, which is a long-term goal.

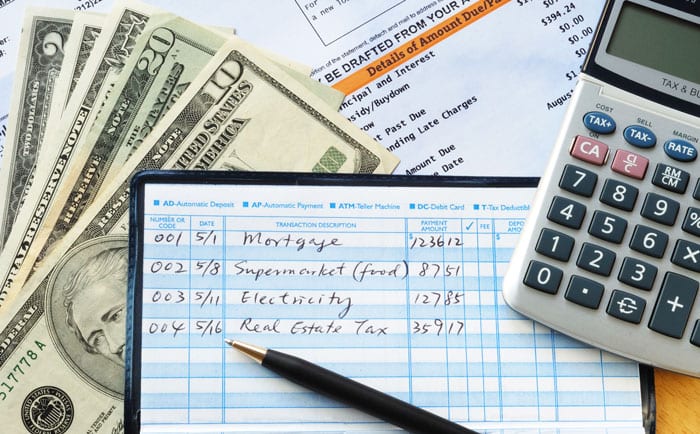

3. Track and Categorise Expenses

It is essential to understand where your money is being spent. To effectively budget your finances, you can use budgeting apps or spreadsheets to outline your expenses in categories. These simple spreadsheets will display how much is spent monthly on housing, transportation, food, entertainment, healthcare, and personal care. This visual presentation will help you to regularly track your money and see where you can cut back on unnecessary expenses.

4. Adopt the Zero-Based Budgeting Method

Zero-based budgeting is an effective strategy to take control of your spending and prevent unnecessary spending. This method ensures all of your income is spent wisely by assigning every dollar of it to a specific purpose. This strategy involves making a note of total income and allocating all of it to categories that cover your expenses, savings, and debt payments. Every single dollar should be distributed into these categories, which may include rent, groceries, or investments.

5. Prepare for Irregular Expenses

Your budgeting may take a hit if you do not plan ahead for irregular expenses such as holiday shopping or car maintenance. It is best to set aside a small fund each month for situations that may pop up and require some spending.

6. Limit Subscription Services

While you may enjoy some subscription services, some you may not actively use and can cancel. You can review all your subscription services, such as streaming services, gym memberships, online shopping subscriptions, and meal kits. These services can silently affect your budget. Therefore, you can cancel the ones you do not use and consider sharing subscriptions with family or friends.

7. Practice Mindful Spending

You can practice mindful spending, which is an effective way to establish your financial wants from your financial needs. While financial needs are essential expenses that you require, financial wants are nonessential. You can align your values and goals with each purchase by considering if you need it, how it relates to your goals, and if you can afford it. Understanding the difference between your financial needs and wants as you practice mindful spending will help to prevent impulsive shopping.